Agribusiness Rural Bank, Inc., one of the top ten rural banking institutions in the Philippines, also known as Agribank, has introduced a world-class new mobile banking App for Android and iOS, developed and delivered by Geniusto International.

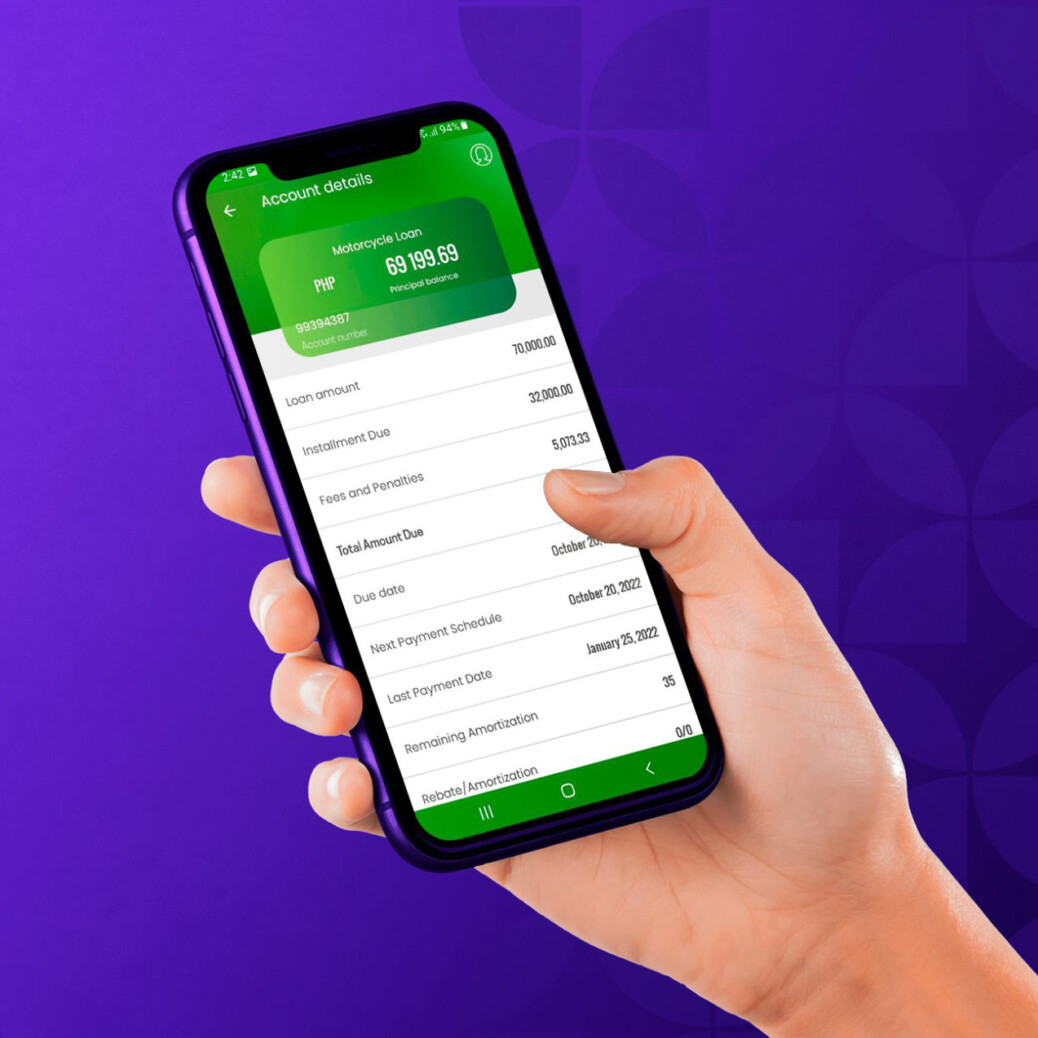

This highly secure and configurable mobile banking platform enables Agribank to offer its customers an amazing, modern, efficient banking experience. The [GO] Omni-Channel Platform offers the built-in ability to publish new services and product offerings in real time, enabling Agribank to enhance the customer experience quickly and seamlessly and stay ahead of the competition.

Working in concert with Geniusto Mobile Banking is Oradian’s advanced cloud-based core banking system. Oradian’s flexible and extensible system uses APIs to power third-party integrations, allowing Agribank to rapidly add new features or launch new products.

On a mission to realise digital transformation and working in collaboration with Geniusto and Oradian, Agribrank is now better able to serve rural communities across the Philippines.

“Exciting times ahead for Agribank indeed as we embark on our digital transformation journey. Agribank dedicates its efforts to ensuring that every Filipino is given access to formal banking facilities and equipped with the necessary knowledge and information. Empowering them with a secure and reliable online banking platform is one of our magnific leaps toward financial inclusivity. Ang serbisyong pang siyudad, dadalhin namin sa kanayunan!

Agribank is making every effort to uphold its corporate tag as “your rural bank that cares.”

At the center of all our efforts to improve our banking services lies our kababayan as we commit to serving the rural and underbanked communities by bringing them the next-generation banking experience.” Says Danny Boy Antonio, President and CEO at Agribank.

Matthew Edmunds, Chief Executive Officer at Geniusto remarked: “By empowering both the rural banks and their customers with mobile banking; we allow the small institutions to remain relevant within their communities and to compete with the huge uni-banks and alternative financial services operators that have been eroding the rural banks traditional role. Small institutions can now provide a Geniusto secure mobile banking application for their customers that quite frankly is, in many cases, more advanced and secure than the competition from the Uni-banks. The institution can build loyalty with their customers and provide an array of relevant services, including loan originations, bills payment, and QR code payments within the community. The institution can now remotely onboard new customers, growing their customer base and ensuring long-term growth and stability for the business.”

Antonio Separovic, Co-Founder and CEO at Oradian, said: “Oradian’s core banking system is designed for connectivity and integration. Our goal is to be the driving force for financial institutions to deliver their services to customers, to provide them with vital access to financing, credit, and banking services. We’re delighted our partnership with Geniusto has enabled it to deliver a transformative mobile banking application for Agribank, so it can continue to deliver innovative financial services to its end users. We’re certain this will further accelerate Agribank’s already impressive growth and provide exciting and accessible experiences for its clients.”

About Geniusto:

Genuisto, based out of Australia, is a technology enabler for banks and financial institutions across Europe, the UK, Southeast Asia, and the USA. Empowering payment providers, remittance companies, eMoney issuers, and more with elegant and efficient solutions so they can deliver an uncompromising customer experience. Genuisto is relied upon by regulated institutions across the world and develops and delivers technology that simplifies the institution’s operations whilst delighting the end customers with relevant products and services.

For more information about Geniusto please visit: www.geniusto.com

About Agribank:

Agribank was established in 1978 as part of the Ropali Group of Companies (RGC). Today they have thirty-three offices nationwide. Inspired to reach unbanked and under-banked communities, Agribank is bringing innovative products and services to market. After four decades of dedicated service, Agribank has twenty-one branches across Nueva Vizcaya and also twelve branch-lites with Business Development Headquarters in Metro Manila. With over 3.6 Billion pesos in assets, they primarily offer lending for agricultural production, farm machineries and the MSME’s – farm enterprises, small hold processors and producers.

For more information about Agribank please visit: www.agribank.com.ph

About Oradian:

Oradian is an extensible, cloud-native core banking solution optimised for financial institutions in emerging markets. It was founded to enable financial businesses to reach more clients, move faster and unlock growth. Oradian powers financial institutions in 12 countries across the world, who are serving over 10 million people. Its advanced banking system integrates seamlessly with your business via evolutionary APIs to provide automated lending, risk management, scoring, accounting, compliance, messaging, reporting and more.

For more information about Oradian please visit: www.oradian.com