How Agribank integrated its business with Oradian’s open APIs

We spoke to Danny Boy Antonio, President and CEO of Agribusiness Rural Bank, Inc, to learn more about how his business harnessed Oradian’s API-first core banking system to reach new market segments and integrate with the bank’s existing systems.

“When the BSP allowed rural banks to go on the cloud, it was like the universe was telling us to use Oradian.”

– Danny Boy Antonio, President and CEO of Agribusiness Rural Bank, Inc,

About Agribank:

Agribusiness Rural Bank, better known as Agribank, was established in 1978 in Nueva Vizcaya, in the Philippines.

It is committed to reaching out to unbanked and underbanked rural communities, offering a range of loan products and savings and deposit accounts designed to increase access to financial services.

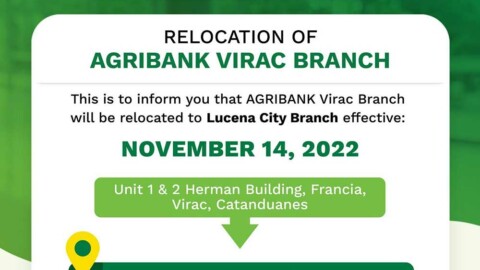

After more than four decades, Agribank has expanded outwards from the province of Nueva Vizcaya, and today operates 21 branches and 12 branch lites across the Philippines.

It is now one of the fastest growing rural banks in the Philippines, supported by over 800 dedicated and well-trained bankers and other financial professionals.

The Challenge:

Agribank started its digitalisation journey in 2015. Prior to that, it had been using a lesser-known, on-premise core banking system, but President and CEO Danny Boy “Dan” Antonio felt it was no longer up to scratch.

Agribank needed a new system that utilised open APIs so it could integrate its existing systems and user interfaces. However, Dan was not initially sold on moving his operations to the cloud.

Agribank investigated several potential systems, but it was a specific technology that attracted the bank to Oradian’s system. “When the BSP [Bangko Sentral ng Pilipinas, the national bank] allowed rural banks to go on the cloud, it was like the universe was telling us to use Oradian,” Dan told us.

“Oradian offered us an open API layer straight out of the box. This meant we could easily integrate their core banking system with our existing loan servicing, origination, and loan officer mobile applications without needing to redevelop everything from scratch. This was a major factor in why Oradian was a good fit and won out in the end.” Dan told us.

The Solution:

Agribank chose Oradian due to its open API-driven core banking architecture, which would allow it to seamlessly integrate its existing systems, and those it chose to adopt in the future.

In addition, Agribank didn’t want to pay for every module individually, so Oradian’s flexible subscription model was ideal.

Agribank spent the Christmas and new year of 2019 implementing Oradian’s system, with the system coming fully online at the beginning of 2020. Dan considers this success to be down to “a great implementation team from Oradian. They worked very closely with my own team and we went live on time.”

The Result:

Using Oradian, Agribank was able to integrate existing systems and improve them, including its loan management and field officer apps.

The flexibility of Oradian’s platform allowed Agribank to adopt workarounds that would allow them to implement these systems quickly and effectively without any interruption to its service.

In addition, Oradian’s cloud-based system allowed Agribank to develop on-the-go apps, for instance for allowing borrowers to sign documents on location, rather than in one of Agribank’s branches.

Agribank’s field officer app utilises real-time data to allow loan officers to log every visit they make to clients; it also feeds them important information for each visit, such as when the customer is likely to be at the property, where the entrances are and even whether a property has a dog of which they need to be wary!

The app had enabled Agribank’s officers to make hundreds, and sometimes even thousands of customer visits every day.

The Future:

In partnership with Oradian and Geniusto, Agribank launched a powerful mobile banking app in October 2022. This was Agribank’s goal from day one.

But Agribank wants to go further, expanding the scope of this new app as it continues its digitalisation journey. “Now,” says Dan “our mobile banking app is robust but basic. We want it to be more advanced, with payments and transactions.”

To achieve this, Sir Dan believes there are four key factors: “APIs, a strong core, a good team, and strategic direction from the top.” He believes Agribank’s success came not just from wise, dedicated leadership, but also from a younger, highly engaged and tech-savvy team that understands how and why APIs are what will drive the firm’s ongoing digitalisation and growth.

Source: https://oradian.com/case-studies/how-agribank-integrated-its-business-with-oradians-open-apis/